Some Known Factual Statements About Bankruptcy Lawyers Near Me

Wiki Article

Our Bankruptcy Business PDFs

Table of ContentsThe 4-Minute Rule for Bankruptcy BenefitsThe Best Guide To Bankruptcy BenefitsThe Only Guide to Bankruptcy Attorney Near MeThe Best Guide To BankruptcyTop Guidelines Of Bankruptcy BenefitsSome Known Details About Bankruptcy Bill

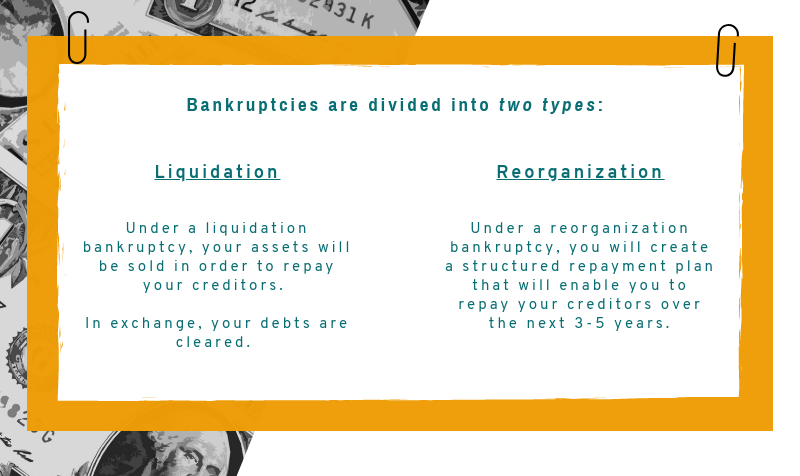

However, the 2 kinds of personal bankruptcy soothe debt in various means. Chapter 7 insolvency, additionally recognized as "straight insolvency," is what most individuals most likely think about when they're considering submitting for insolvency. Under this kind of bankruptcy, you'll be needed to permit a federal court trustee to monitor the sale of any type of assets that aren't exempt (autos, occupational tools and fundamental home home furnishings may be excluded).Here are a few of the most typical as well as essential ones:: This is the person or corporation, appointed by the personal bankruptcy court, to act on behalf of the creditors. He or she assesses the debtor's application, liquidates residential or commercial property under Chapter 7 filings, as well as distributes the proceeds to lenders. In Phase 13 filings, the trustee likewise supervises the debtor's settlement strategy, receives settlements from the debtor and also disburses the cash to creditors.

Once you have actually filed, you'll likewise be needed to complete a training course in individual economic monitoring before the bankruptcy can be discharged. Under particular conditions, both demands might be waived.: When insolvency process are full, the bankruptcy is thought about "released." Under Chapter 7, this happens after your properties have actually been sold and lenders paid.

Unknown Facts About Bankruptcy Lawyers Near Me

The Insolvency Code needs individuals who want to file Chapter 7 bankruptcy to show that they do not have the means to repay their financial obligations. The demand is intended to reduce misuse of the personal bankruptcy code.If a borrower stops working to pass the methods examination, their Chapter 7 bankruptcy may either be disregarded or exchanged a Phase 13 case. Under Phase 7 insolvency, you might consent to proceed paying a debt that can be discharged in the proceedings. Reaffirming the account and your dedication to pay the financial obligation is usually done to permit a debtor to maintain a piece of security, such as an auto, that would certainly or else be taken as part of the personal bankruptcy procedures.

Personal bankruptcies are thought about negative info on your credit scores record, and can impact how future lending institutions watch you - Bankruptcy. Seeing a bankruptcy on your credit report documents might prompt creditors to decrease extending you credit rating or to offer you higher rate of interest and much less beneficial terms if they do make a decision to provide you credit history.

Little Known Facts About Bankruptcy.

Insolvency details on your credit scores report may make it extremely hard to get additional credit scores after the personal bankruptcy is discharged at the very least till the info cycles off your credit rating report.Research study financial obligation loan consolidation financings to see if debt consolidation can decrease the complete amount you pay and also make your debt a lot more workable. Failing on your financial debt is not something your creditors intend to see take place to you, either, so they may be prepared to work with you to arrange a more possible repayment strategy.

The Facts About Bankruptcy Attorney Revealed

Monitoring your credit history report. Producing and sticking to a personal budget plan. Making use of credit report in tiny methods (such as a safeguarded charge card) and also paying the balances completely, immediately.Bankruptcy is a bankruptcy birmingham al legal action launched when an individual or organization is unable to settle exceptional financial obligations or obligations. The bankruptcy procedure starts with a petition filed by the debtor, which is most typical, or in support of lenders, which is much less typical. All of the borrower's assets are determined as well as assessed, and the properties might be used to repay a portion of the arrearage.

Any kind of choices in government personal bankruptcy instances are made by an insolvency court, consisting of whether a debtor is eligible to submit as well as whether they must be discharged of their debts.

Some Known Details About Bankruptcy Benefits

Their liked stockholders, if any type of, may still obtain payments, though usual shareholders will not. As an example, a housekeeping service filing Phase 11 personal bankruptcy could boost its rates a little and provide more services to become profitable. Chapter 11 bankruptcy enables the service to continue performing its organization tasks without disturbance while working with a debt settlement plan under the court's supervision.Phase 12 insolvency gives alleviation to family farms and also fisheries. They are enabled to maintain their organizations while working out a strategy you can look here to repay their financial obligations. Phase 15 personal bankruptcy was included to the regulation in 2005 to manage cross-border instances, which involve borrowers, possessions, creditors, and also various other parties that may be in more than one country.

Not all debts certify to be discharged. Some of these include tax cases, anything that was not noted by the debtor, child support or spousal support repayments, individual injury debts, and also debts to the government.

A Biased View of Bankruptcy Court

When a petition for personal bankruptcy has been filed in court, creditors receive a notification as well as can object if they choose to do so. If they do, they will certainly require to file a grievance in court before the deadline. This brings about the filing of an enemy proceeding to recover money owed or impose a lien.Report this wiki page